Condo Insurance in and around Westlake Village

Unlock great condo insurance in Westlake Village

Insure your condo with State Farm today

Your Belongings Need Coverage—and So Does Your Condo.

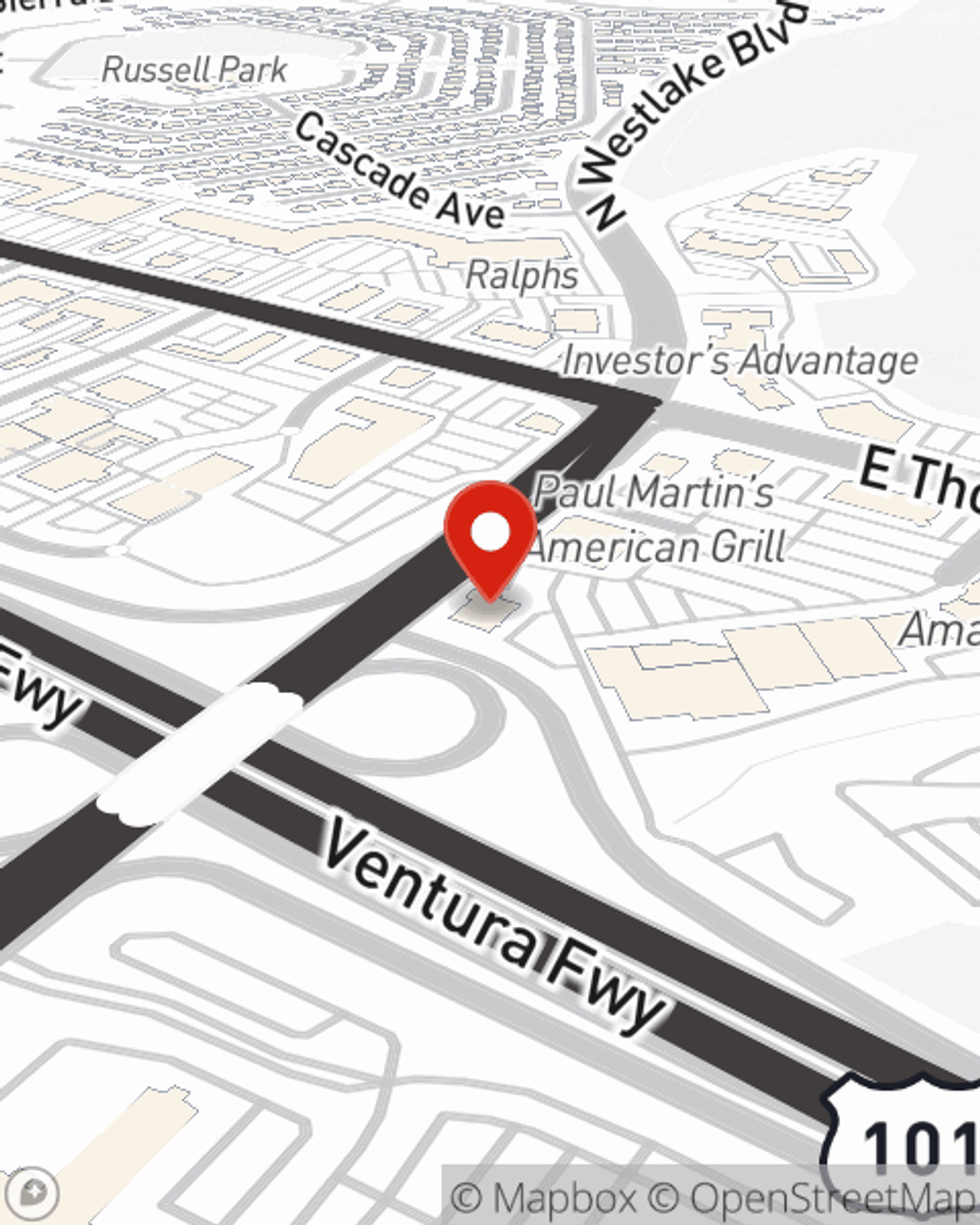

You have plenty of options when it comes to choosing a condominium unitowners insurance provider in Westlake Village. Sorting through deductibles and coverage options can be overwhelming. But if you want budget friendly condo unitowners insurance, choose State Farm for covering your condo and personal belongings. Your friends and neighbors in Westlake Village enjoy unmatched value and straightforward service by working with State Farm Agent Chris Bluth. That’s because Chris Bluth can walk you through the whole insurance process, step by step, to help ensure you have coverage for your condo as well as electronics, swing sets, appliances, home gadgets, and more!

Unlock great condo insurance in Westlake Village

Insure your condo with State Farm today

State Farm Can Insure Your Condominium, Too

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your condo unit from a windstorm, theft or an ice storm.

There is no better time than the present to contact agent Chris Bluth and learn about your condo unitowners insurance options. Chris Bluth would love to help you find the most appropriate coverage for you.

Have More Questions About Condo Unitowners Insurance?

Call Chris at (805) 495-5900 or visit our FAQ page.

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Chris Bluth

State Farm® Insurance AgentSimple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.